2025 Market Trends in Pneumatic Valves for Global Buyers

As industries move towards automation and increased efficiency, the demand for pneumatic valves is expected to soar in the coming years. According to a recent market research report by Research and Markets, the global pneumatic valves market is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2025, driven by advancements in manufacturing technologies and a focus on optimal resource management.

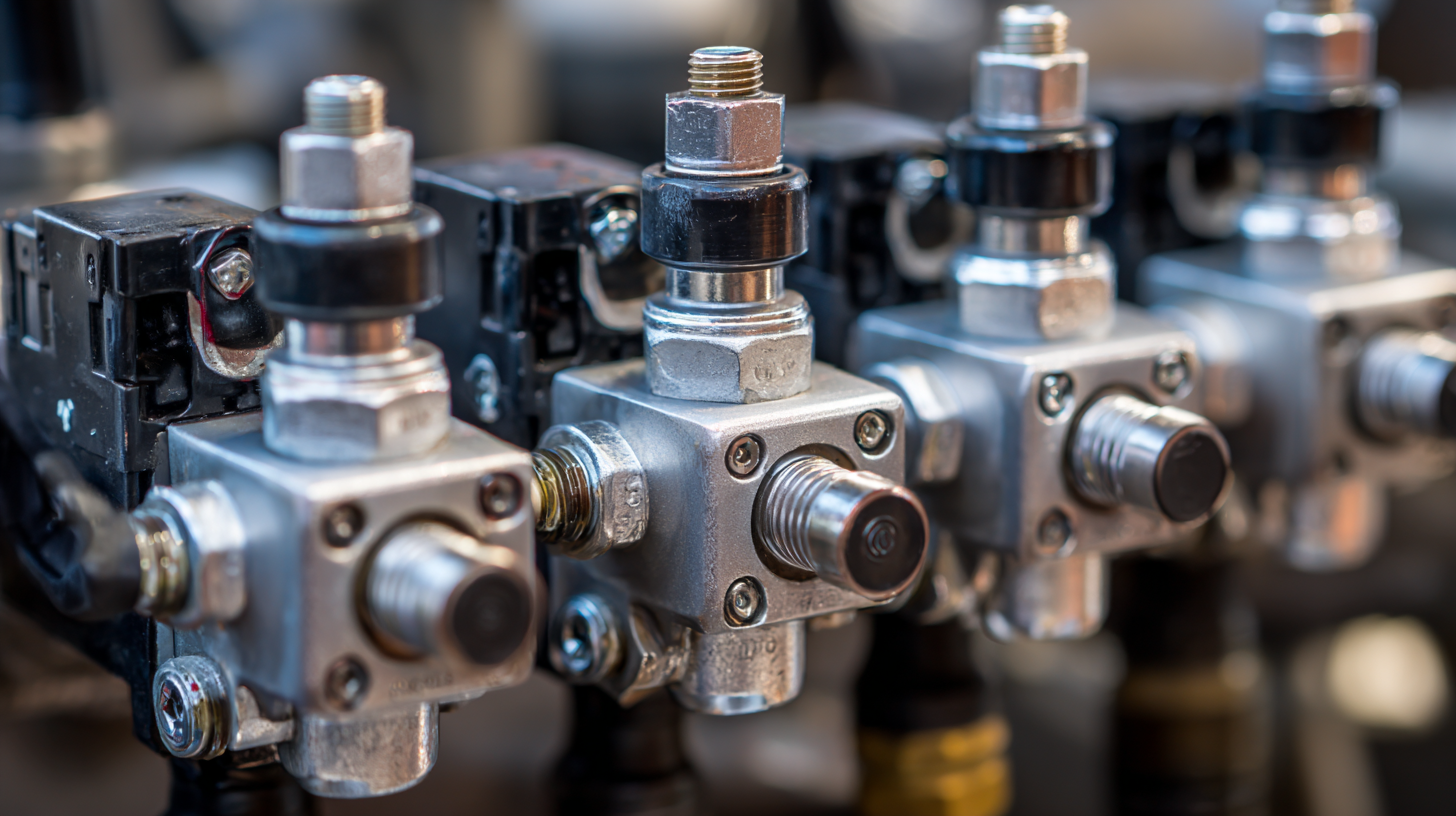

These valves play a critical role in controlling fluid power systems and are crucial in various applications ranging from industrial automation to food processing. With an increasing emphasis on sustainability and operational efficiency, global buyers must stay informed about the evolving trends in pneumatic valves to make strategic purchasing decisions that align with future market demands. This blog aims to delve into the 2025 market trends of pneumatic valves, offering insights to help stakeholders navigate this dynamic landscape.

These valves play a critical role in controlling fluid power systems and are crucial in various applications ranging from industrial automation to food processing. With an increasing emphasis on sustainability and operational efficiency, global buyers must stay informed about the evolving trends in pneumatic valves to make strategic purchasing decisions that align with future market demands. This blog aims to delve into the 2025 market trends of pneumatic valves, offering insights to help stakeholders navigate this dynamic landscape.

The Growing Demand for Pneumatic Valves in Key Industries: An Analysis of 2025 Market Trends

The growing demand for pneumatic valves across key industries is set to significantly shape market trends in 2025. As automation becomes integral to manufacturing, oil and gas, and energy sectors, the pneumatic actuator market is anticipated to experience steady growth. Reports indicate that the global industrial valve market is poised to increase from an estimated $95.58 billion in 2024 to $121.67 billion, driven by these advancements. Notably, the semiconductor vacuum valve market is also on the rise, with projections showing an increase from $0.63 billion in 2024 to reach $1.0 billion by 2031.

As buyers navigate the evolving landscape of pneumatic valves, it is essential to consider a few key tips. First, prioritize the selection of energy-efficient solutions that not only meet operational needs but also contribute to sustainability goals. Secondly, staying updated on the latest technological advancements in valve automation can provide a competitive edge. Finally, collaborating with suppliers who understand industry-specific requirements can lead to better performance and reliability in valve applications. These strategies will empower global buyers to make informed decisions while capitalizing on the upward trends in the pneumatic valve market.

2025 Pneumatic Valves Market Trends

Top Competitive Strategies for Global Buyers in the Pneumatic Valve Sector

As the demand for pneumatic valves continues to surge in 2025, global buyers must adapt their competitive strategies to thrive in this evolving market. One key approach is to focus on strategic partnerships with manufacturers that emphasize innovative designs and advanced technology. Collaborating with suppliers who invest in research and development can enhance product quality and reliability, ultimately reducing costs and downtime for buyers. This proactive strategy will not only improve supply chain efficiency but also provide a competitive edge in an increasingly crowded marketplace.

Moreover, embracing sustainability will play a crucial role in shaping purchasing decisions. Buyers should prioritize manufacturers that implement eco-friendly practices and produce energy-efficient pneumatic valves. By aligning with these suppliers, companies can appeal to environmentally conscious customers and adhere to emerging regulations on sustainability. Additionally, investing in automation and smart technologies can also be a game-changer. Integrating Internet of Things (IoT) capabilities into pneumatic systems can enhance operational efficiency and provide valuable data analytics for buyers, setting them apart from competitors who stick to traditional methods.

Innovations in Pneumatic Valve Technology: Enhancing Efficiency and Performance in 2025

The pneumatic valve industry is poised for significant advancements in 2025, driven by innovative technologies that enhance efficiency and performance. As industries increasingly gravitate towards automation, the demand for more sophisticated pneumatic valves is on the rise. Innovations such as smart sensors integrated into pneumatic valves allow for real-time monitoring and data collection, enabling manufacturers to optimize their processes and reduce downtime. These technological enhancements not only improve precision but also facilitate predictive maintenance, ultimately leading to cost savings and increased productivity.

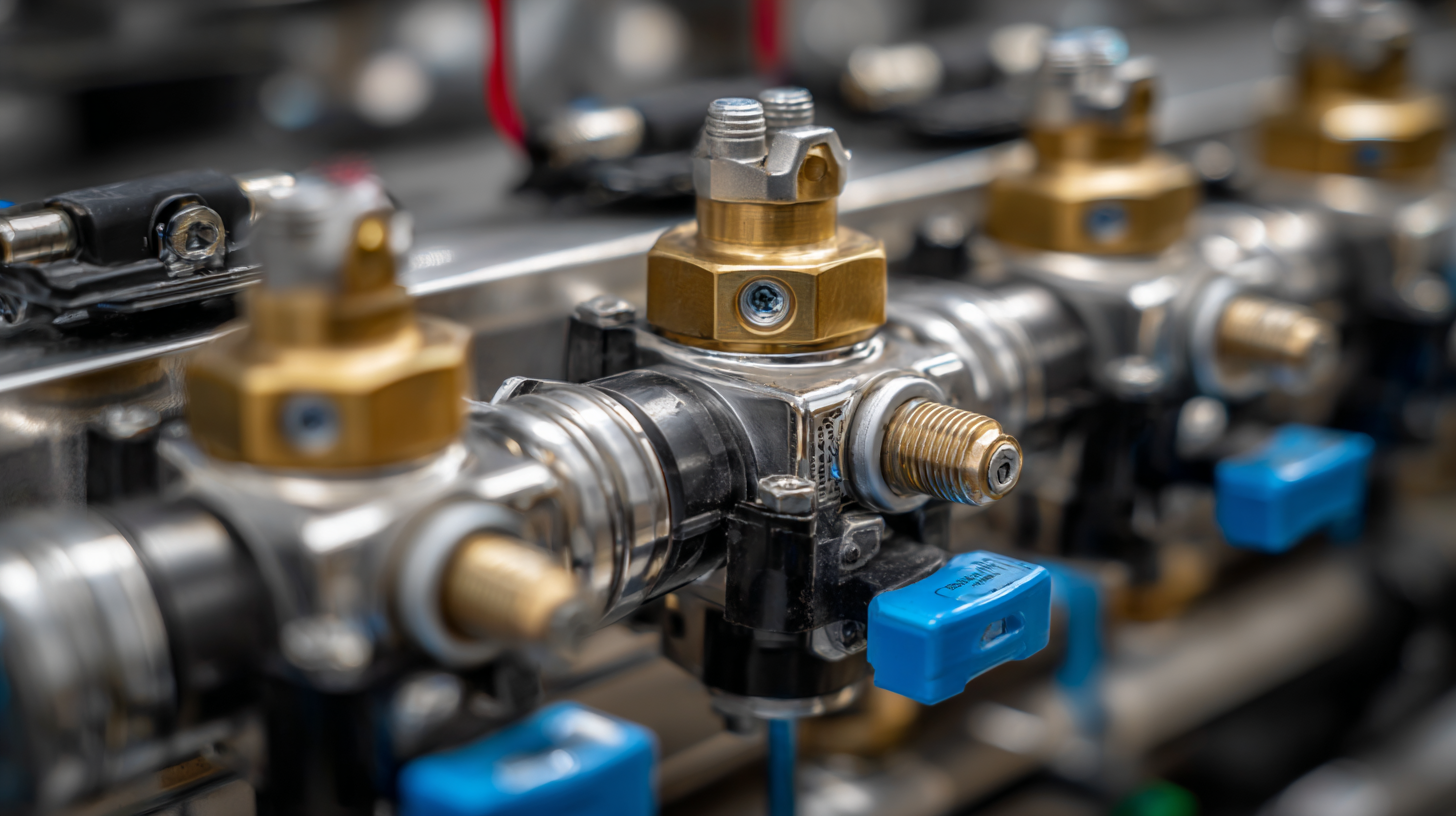

Moreover, the development of lightweight and durable materials is transforming the design of pneumatic valves, resulting in products that are both more efficient and environmentally friendly. For instance, the rise of composite materials enables valves to withstand higher pressures while also contributing to energy savings. Manufacturers are also focusing on energy-efficient actuation systems, which minimize power consumption without compromising performance. As a result, companies adopting these cutting-edge technologies are likely to gain a competitive edge in the fast-evolving global market, making 2025 a pivotal year for pneumatic valve advancements.

Regional Insights: The Impact of Geographic Markets on Pneumatic Valve Sales

As the global market for pneumatic valves continues to evolve, geographical variations emerge as significant drivers of sales trends. Different regions exhibit unique demand patterns, influenced by local industries, regulatory frameworks, and technological advancements. In North America, for example, the booming industrial sector and the adoption of automation technologies are leading to a heightened demand for pneumatic valves. Conversely, Asia-Pacific is witnessing rapid industrialization, particularly in manufacturing and construction, creating robust opportunities for growth in this segment.

Furthermore, regional insights reveal the impact of economic conditions on pneumatic valve sales. In developed markets, the focus is increasingly on high-efficiency valves that meet stringent environmental standards. Meanwhile, in developing regions, cost-effective solutions are more prevalent as companies seek to balance quality and budget constraints. These insights highlight the critical role that regional dynamics play in shaping the future landscape of the pneumatic valve market, providing global buyers with the information needed to make informed purchasing decisions and adjust their strategies accordingly.

2025 Market Trends in Pneumatic Valves for Global Buyers - Regional Insights

| Region | Market Size (USD Million) | Growth Rate (%) | Key Applications | Recent Trends |

|---|---|---|---|---|

| North America | 450 | 5.1 | Automotive, Aerospace | Increased automation |

| Europe | 400 | 4.5 | Packaging, Food & Beverage | Sustainability focus |

| Asia-Pacific | 600 | 6.0 | Manufacturing, Electronics | Digital transformation |

| Latin America | 150 | 3.8 | Oil & Gas, Mining | Infrastructure development |

| Middle East & Africa | 200 | 4.0 | Water Treatment, Power Generation | Investment in renewable energy |

Sustainability in Manufacturing: How Eco-Friendly Practices Shape the Pneumatic Valve Market

In recent years, the pneumatic valve market has witnessed a significant shift towards sustainable manufacturing practices. As global awareness of environmental issues grows, manufacturers are increasingly implementing eco-friendly initiatives in their production processes. This trend not only addresses regulatory pressures but also aligns with consumer demands for greener products. Companies are adopting materials that are recyclable and reducing energy consumption during manufacturing, thereby minimizing their carbon footprint.

Moreover, the integration of modern technologies such as Industry 4.0 allows for smarter, more efficient manufacturing operations. Automation and data analytics contribute to optimizing production processes, leading to reduced waste and improved resource management. As buyers become more discerning, choosing suppliers who prioritize sustainability can enhance their brand reputation and appeal to a wider audience. Ultimately, sustainability is no longer just an option; it has become a fundamental aspect that shapes the future of the pneumatic valve market, influencing buying decisions and long-term partnerships.